The Full Circle Programme

Redesigning Catch 22's Finance Benefit and Debt programme

to build financial agency for People on Probation (PoP)

(March 2025- August 2025)

INDUSTRY

Criminal Justice

FOCUS AREA

TARGET AUDIENCE

Offender management and rehabilitation

People on Probation

CLIENT

Catch22 is a UK based social enterprise that partners with the Ministry of Justice to support people on probation with rehabilitation and resettlement services both inside prisons and in the community. Through its Finance, Benefit & Debt (FBD) programme, Catch22 delivers tailored financial guidance, benefits navigation, and debt-management support to help probationers rebuild independence and gain control over their lives after prison.

OVERVIEW

The project focused on redesigning Catch22’s Finance, Benefit & Debt (FBD) programme to better support people transitioning from prison to probation, a period marked by instability, compromised agency, and limited support.

Through interviews with probationers, practitioners, and experts, we mapped the UK justice and probation ecosystem to identify critical gaps: static financial content, low engagement, overstretched officers, and a lack of tangible pathways to rebuild independence.

Our research revealed that while probationers are not unfamiliar with money, they struggle with confidence, documentation, and navigating systems after years of confinement.

We reframed the challenge from “improving sessions” to building progressive financial agency. The redesigned model, "The Full Circle Programme", introduces:

-

Peer facilitators lived-experience

-

Real-life financial simulations

-

A reframed first touchpoint that replaces form-filling with a welcoming, trust-building “Build Session.”

CONTEXT

Understanding the system

In the UK’s criminal justice system, people leaving prison enter probation, a critical but unstable transition marked by limited support, overstretched officers, and complex financial responsibilities.

Catch22’s Finance, Benefit & Debt (FBD) programme supports probationers during this period; however, engagement remains low, and sessions often feel disconnected from the realities of

re-entering society.

Understanding Probationers (Service Users)

Probationers aren’t completely alien to finance, they seek help for documentation and they look forward to either being employed or to get their finances under control.

_Page_10.jpg)

THE PROBLEM

Multiple gaps to solve for within the current user flow

_pptx.jpg)

3

2

1

Attendance is consequence-oriented and not incentive-oriented

Probationers attend financial sessions because they are required to, not because they see personal value.

Sessions are not engaging enough

Traditional content is static and disconnected from their lived experiences, while the first touchpoint (form-heavy assessments) reinforces feelings of surveillance and low agency.

Sessions are not often not relevant to the Probationers

Many probationers, often neurodivergent or navigating unstable housing and employment, struggle to meaningfully engage with financial information delivered without empathy, continuity, or relevance.

But these gaps pointed us to a deeper issue.

Probationers are navigating an abrupt shift from

total control to total responsibility.

Agency can’t be assumed; it must be rebuilt.

People with upbringing in unforgiving environments,

years of confinement, having been told what to do every minute.

To suddenly one day you are given the responsibility to get your life together and understand your finances.

Insight 1

The transition from prison to probation means having to deal with an overnight expectation of agency.

So then, how might we use the FBD programme to

ease probationers into society and achieve financial agency?

THE APPROACH

We reframed the challenge from improving financial sessions to building financial agency. Our approach combined:

User interviews with probationers to understand needs, their relationship with money, anxieties, and aspirations

Service journey mapping to identify friction points from referral to programme completion

Ecosystem mapping to analyse stakeholder roles, and system-wide disconnects

Rapid prototyping of redesigned touchpoints to test motivations, emotional resonance and engagement

_pptx%20(1).jpg)

Insight 2

Introducing gradual exposures to society in the program will result in progressive agency for probationers because interacting with tangible hope would make them confident about their finances.

This led to a shift from isolated modules to a continuous, relationship-centred programme supported by new stakeholders, including peer mentors with lived experience.

THE STRATEGY

1. New Stakeholders

While Catch 22 is still responsible for running the sessions, the other stakeholders come in to facilitate

the session when needed.

Catch 22

Practitioner

Prison leaver

employees

from ext. organisations

2. From silos to continuity

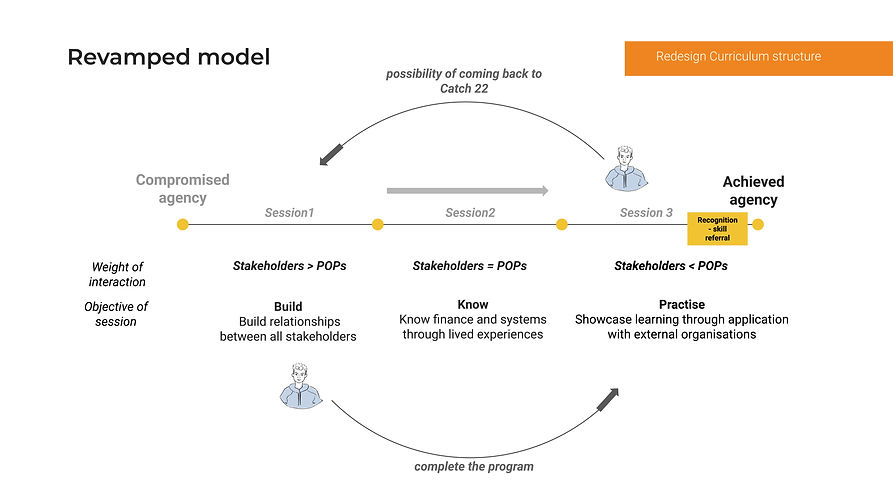

From having Finance, benefit and debt as three separate sessions, we would like the sessions to work in continuity and follow a sequence. The goal is to go from compromised agency to having achieved agency

It also allows probationers to get to know each other better and build a good relationship with the practitioners throughout the whole process.

Compromised agency

Achieved

agency

3. Rethinking the first touchpoint

The first touchpoint (IAT) itself is off-putting, making probationers relive experiences they might not be comfortable with.

The redesigned first touchpoint, the Build Session, replaces form-filling with a welcoming, trust-building environment and builds a strong foundation for the upcoming sessions.

Designing the "Build Session"

Introducing tangible hope

The Build Session creates a safe space by incorporating elements such as round tables, stakeholders sharing conversations over a meal, and a wall of fame featuring stories of FBD graduates who have excelled after probation.

Probationers come in unsure what to expect from the session and leave seeing potential in what 'The Full Circle Program' is offering them

How will the session progress?

1

2

3

Welcome & Icebreaker

Inspiration

Personal Reflection

Stakeholders open the session by sharing their personal journeys, including life after prison, creating a safe, relatable environment and lowering initial anxiety.

The practitioner introduces inspiration cards featuring real success stories,

ex-prisoners who have started businesses, secured employment, or collaborated with organisations like InHouse Records, helping probationers see what is possible.

Probationers engage with reflective materials such as zines, playful prompts, and a small “fortune cookie” moment. These tools encourage them to examine their relationship with money in a low-pressure, exploratory way.

4

Takeaways

The session closes with informal conversations, exchange of stakeholder business cards, and a curated set of takeaway materials. Probationers leave having reflected on their finances, built meaningful connections, and experienced a positive first step towards financial agency.

SUMMARY

Value proposition canvas for The Full Circle Programme

Group Members: Meghna Gopalan, Desiree Dsouza, Tianxiao Yuan, Jialu Shen, Sakshi Breed

Duration: October 2024 - February 2025